Amid an environment of rising inflation, interest rates, and cost of living, along with continued labour shortages and supply chain issues, Dr Jim Chalmers delivered the Albanese government’s first budget on Tuesday 25 October 2022.

Looking at the numbers

The Treasurer revealed a $36.9 billion deficit (1.5 per cent of GDP), well under the $78 billion shortfall predicted in the previous government’s projections in March this year. While the federal budget is $41.1 billion better off, there is a predicted decline in conditions in two years’ time.

Treasurer Chalmers announced that “our spending audit has helped identify $22 billion in savings over the next 4 years”. However, deficits will be worse in the out years than previously expected due to substantially higher spending on the cost of debt, aged and health care, and the National Disability insurance Scheme (NDIS).

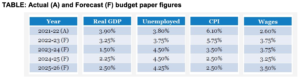

Budget forecasts also included downgrades to domestic and international economic growth. While the economy is forecast to grow by 3.25 per cent in 2022–23, the “weaker global outlook, high inflation, cost-of-living pressures, and higher interest rates” are expected to see growth slow to 1.5 per cent in 2023–24.

According to the budget papers, annual inflation is expected to peak at 7.75 per cent in late 2022, before moderating gradually to 3.5 per cent by June 2024 and returning to the Reserve Bank’s inflation target by 2024–25. The unemployment rate is forecast to rise to 4.5 per cent by the June quarter of 2024 but remains below pre-pandemic levels.

Budget objectives

The budget has been characterised as “a solid and sensible budget, suited to the times we live in and the conditions we confront”, with the objectives of responsible cost-of-living relief, strengthening the economy, and beginning to build a better future by beginning the hard yards of budget repair.

Highlights of Superannuation, taxation, Social Security and housing initiatives are outlined below.

Superannuation

- Reducing the eligibility age to make downsizer contributions: Legislation has been introduced to further reduce the downsizer eligibility age from 60 to 55. This change will take effect from the first of the first quarter after it is passed into law, which is anticipated to be 1 January 2023.

- SMSF and tax residency: Confirmed intention to continue with the 2021/22 Budget announcement of extending the temporary trustee absence period from 2 years to 5 years, along with removing the ‘active member’ test. Implementing these changes will help SMSFs to continue to maintain their Australian tax residency, even while members are overseas, and allow them to continue to contribute to their funds even if they become non-tax residents.

- Three-year audit cycle for SMSFs not proceeding: Originally announced as part of Liberal’s 2018/19 Budget, Labor has confirmed that they will not proceed with this change and will retain the current audit cycle for SMSFs.

Taxation

- No additional changes to personal income tax: There were no newly announced changes to personal income tax measures. This includes:

- no changes to the Liberal Government announced Stage 3 tax cuts which were proposed to take effect from 1 July 2024

- no extension of the Low- and Middle-Income Tax Offset (LMITO), which ended 30 June 2022.

- Support for fuel-efficient vehicles: For purchases of battery, hydrogen, or plug-in hybrid cars with a retail price below $84,619 (the luxury car tax threshold for fuel efficient vehicles) after 1 July 2022, fringe benefits tax and import tariffs will not apply. However, employers will still need to account for the cost in an employee’s reportable fringe benefits.

Social Security

- Childcare subsidy changes: The maximum childcare subsidy is proposed to increase from 1 July 2023 to 90% for families earning less than $80,000. For every $5,000 earned over this threshold, the subsidy will reduce by 1% – tapering off to zero for families with income above $530,000. This is a much simpler subsidy calculation than the current system.

- Paid parental leave increases: It is proposed that from 1 July 2024 the Paid Parental Leave Scheme will increase the maximum period of leave by two weeks each year, to reach a maximum of 26 weeks by 1 July 2026. In addition, from 1 July 2023, both parents will be able to access leave at the same time or enter more flexible arrangements than currently available under the limited ‘Dad and Partner Pay’ limits. The paid parental leave income test will also be extended to include a $350,000 family income test.

- Work Bonus deposit for older Australians: As previously announced, age pensioners and veterans over service pension age are expected to receive a one-off credit of $4,000 into their Work Bonus income bank. The Work Bonus typically offsets $300 per fortnight of income earned from employment or self-employment activities. In effect, this will allow pensioners to earn more income without impacting their age pension entitlements.

- Increased income thresholds for Commonwealth Seniors Health Card: Labor has committed to increasing the income thresholds for the Commonwealth Seniors Health Card up to $90,000 for singles and $144,000 combined for couples when assessing eligibility.

- Extension of deeming rate freeze: The Government has confirmed its intention to retain the current level of deeming rates until at least 30 June 2024.

- Reducing the cost of medicine: From 1 January 2023, the general patient co-payment for Pharmaceutical Benefits Scheme treatments is expected to reduce from $42.50 to a maximum $30.

Housing initiatives

- Housing affordability measures: This budget has focused on increasing access to housing for Australians. This is expected to occur largely via the Housing Accord, combining the efforts of Federal, State, and Local Governments to work on housing affordability and reducing homelessness. Measures announced include:

- A commitment to the ‘Help to Buy’ scheme, to assist first home buyers in buying a home with the Federal Government being a part owner.

- A Regional First Home Buyer Guarantee, effective from 1 October 2022 which is expected to assist up to 10,000 first home buyers with mortgage guarantee, removing the need for lenders mortgage insurance and allowing them to buy with a lower deposit sooner.

As with all budget announcements, it must be noted that many of these proposals are currently just that, proposals, and these initiatives, if implemented will need to pass legislation through a Senate, where the sitting government does not currently have a majority.

The information contained in this article is general information only. It is not intended to be a recommendation, offer, advice or invitation to purchase, sell or otherwise deal in securities or other investments. Before making any decision in respect to a financial product, you should seek advice from an appropriately qualified professional.

We believe that the information contained in this document is accurate. However, we are not specifically licensed to provide tax or legal advice and any information that may relate to you should be confirmed with your tax or legal adviser.